Dear Shareholders:

Throughout its history, Curtiss‑Wright has concentrated on developing a robust and diversified portfolio of advanced engineered products and services for critical applications, high-technology capabilities and a presence in markets with excellent growth prospects. We intend to realize the growth opportunities presented by this portfolio through new product development, market share growth and international expansion initiatives. As Curtiss‑Wright continues to evolve and acquire new technologies, we have reached an inflection point upon which we are transforming key operations within our business to ensure continued success for years to come.

Curtiss‑Wright’s well-established portfolio provides a strong platform to support our organic growth opportunities. We expect to complement this growth with strategic acquisitions, and in the process reinforce our objectives to develop and enhance our technical capabilities to serve faster growing market segments and to position us on high-performance platforms in the markets we serve.

Six acquisitions late in 2012 (and one in early 2013) illustrated the Company’s commitment to acquire strategic, niche technologies that broaden our portfolio and expand our market presence and geographic reach. They also serve to transform and further diversify our product offerings across numerous markets, including advanced, electric-powered wheeled vehicles and newly added systems capabilities to complement our existing sensors and controls business in the high-end industrial market, as well as both upstream and midstream capabilities serving the oil and gas market.

Furthermore, with approximately 30% of our sales to international customers, our global footprint continues to expand, as we pursue new markets and technologies to broaden the scope and penetration of our products and services.

Whether you are fairly new to Curtiss‑Wright or have been following the Company for many years, you have seen this acquisition strategy unfold as we continue to incorporate new technologies to bolster our portfolio.

Overall, Curtiss‑Wright remains focused on the future, and we are taking the necessary steps to transform our business for future growth.

Reflecting on our 2012 Financial Performance

During the past year, our business faced numerous challenges. Our performance reflected several planned actions that we expect will benefit our future results, such as ongoing cost reduction and restructuring initiatives across our operations, and divesting of non-core operations. But it also involved a series of unplanned investments and activities, including a prolonged labor strike in one of our largest manufacturing facilities and softness in the defense markets. We also had to make additional investments related to our first-of-a-kind reactor coolant pump technology supporting the Westinghouse AP1000® reactor. However, I am pleased to report that we have shipped the first four pumps under our initial China contract, and our future results will reflect improved profitability as we progress through the initial U.S. and all future AP1000 contracts.

So, if we exclude certain impacts that were one-time in nature, I believe this past year will serve as a solid stepping stone from which to shape and grow our future profitability, as Curtiss‑Wright remains well positioned for solid growth and improved operating efficiency in 2013 and beyond.

Net sales of $2.1 billion in 2012 increased 4% from the prior year, driven by solid demand for our unique and highly engineered products and services, particularly in our Surface Technologies segment.

Solid growth of 11% in the commercial markets was led by yet another strong performance in the commercial aerospace market, as we benefited from continued production rate increases on various Boeing and Airbus platforms. Our results included continued strong sales of sensors and controls, and peening services to both of our key customers, as well as increased sales opportunities being generated by our emergent operations facility supporting the Boeing 787 program. Elsewhere, the energy markets produced a solid performance. Sales in the power generation market were led by growth on U.S. AP1000 projects and continued aftermarket activity tied to maintenance, upgrades, and obsolescence solutions serving operating nuclear power plants. We also experienced an uptick in demand for products supporting new regulations from the Nuclear Regulatory Commission (NRC) for enhanced safety and spent fuel pools, which tie directly into Curtiss‑Wright’s core offerings in this market. In addition, while oil and gas market sales benefited from solid Maintenance, Repair and Overhaul (MRO) activity, those gains were partially offset by the continued impact of lower worldwide capital spending on larger projects across the industry.

Meanwhile, sales in the defense markets declined 6% in 2012. We experienced lower sales in the naval defense market as a result of timing and contract completions on certain long-term contracts, despite increased production of pumps and valves supporting the new CVN-79 aircraft carrier. Sales in the aerospace defense market were essentially flat, as increased demand on various helicopter programs was offset by reduced sales for the Triton unmanned aerial vehicle program as we transition from the development to the production phase. Elsewhere, we saw continued softness in the ground defense market due to lower Department of Defense (DoD) investment in several large ground vehicle programs.

We await further clarity from Washington regarding the decision to modernize the existing fleet or increase investment in next-generation ground platforms. Looking ahead, despite expectations from the DoD for lower overall top-line defense spending and the likelihood of discretionary budget cuts impacting the industry over the next few years, I remind you that the balance provided by our overall diversification provides some downside protection to Curtiss‑Wright, even in less favorable defense environments. In addition, our long-term view in defense remains solid, based on our enduring presence as a key supplier to the U.S. Navy, as well as our optimism tied to the government’s increased focus and continued planned investment in key platforms supported by new Intelligence, Surveillance, and Reconnaissance (ISR), unmanned, electronic warfare, and communications capabilities—areas where Curtiss‑Wright continues to play a key role, particularly with our market-leading embedded computing products.

Our operating profitability was negatively impacted by several of the aforementioned planned and unplanned actions, resulting in a 14% reduction in operating income from continuing operations to $161 million and an operating margin of 7.7%. However, it is worth noting that our Controls segment achieved solid margin expansion based on demand for our sensor and control products and the benefits generated by our business restructuring and cost reduction efforts. In addition, our earnings from continuing operations were $92 million, or $1.95 per diluted share. However, excluding the impact of the dilution from our fourth quarter and pending acquisitions, adjusted diluted earnings per share were $2.08.

During 2012, we booked new orders of nearly $2.0 billion, a slight decrease from the prior year, resulting in a full-year backlog of approximately $1.7 billion. This backlog reflects our position as a premier supplier of products and services supporting safety-related upgrades on operating commercial nuclear power plants and strong demand coming from the commercial aerospace market, offset by the timing of funding on certain naval defense programs and lower demand for equipment serving downstream refinery projects in the oil and gas market.

Our free cash flow, defined as cash flow from operations less capital expenditures, was $70 million for the year, equating to a 61% cash conversion based on earnings from continuing operations.

Disciplined Capital Deployment Strategy

We remain committed to a disciplined capital deployment strategy of reinvesting in our business and growing through acquisitions, combined with our continued commitment to increasing shareholder value through earnings per share growth, dividends, and share repurchases.

During 2012, we maintained an active stock repurchase program and opportunistically purchased 830,000 shares to provide support and reflect our confidence in the stock price. We also implemented a 12.5% increase in our annual dividend in 2012, reflecting the Board’s continued confidence in our ability to deliver strong revenue and profitability growth, along with solid free cash flow generation, as we execute our long-term strategic plan.

We announced the successful establishment of a $500 million credit facility, with an accordion feature to expand to $600 million, to replace our existing lines of credit, which allows us to more closely align our capital structure with our overall corporate growth strategies.

Our balance sheet remains strong with a net debt-to-book capitalization of 40%, including $574 million in senior notes, and provides a solid base of financial flexibility to continue the pursuit of our strategic goals to grow both organically and through niche acquisitions.

Operational Transformations

As noted earlier, 2012 was an active year for acquisition activity as it has greatly contributed to some of the operational transformations that are taking place across the organization. As a result, I believe it is beneficial to provide additional color on some of the exciting changes that have been and will continue to impact the future of Curtiss‑Wright.

Evolution and Transformation of the Surface Technologies Segment

One significant transformation that took place in 2012 was officially changing the Metal Treatment segment name to Surface Technologies, which we believe better aligns this business with its broad collection of highly technical service offerings.

Building on our successful expansion into high-technology specialty coatings in 2011, we added F.W. Gartner Thermal Spraying, Ltd. late in 2012 to further strengthen our global coatings offering into the upstream oil and gas, petrochemical, power generation, and other premium industrial markets. Gartner is a pioneer in the application of thermal spray and wear-resistant protective coatings that extend the life of severe service industrial components, and is a perfect strategic fit within the segment. We expect to leverage the significant cross synergies that exist between our thermal spray businesses and capitalize on worldwide growth opportunities to become one of the leading providers of thermal spray coatings capabilities.

During 2012, we completed the divestiture of the highly cyclical and non-complementary heat treating business, and exited non-core, low profitability businesses, which collectively we believe will reduce the volatility that often impacted this segment’s financial performance and will enhance its future profitability.

I also wanted to mention the promotion of Larry Peach to President of our Surface Technologies segment. Larry is a seasoned executive of Curtiss‑Wright with a strong record of accomplishment, and I am confident in his ability to lead this segment in attaining its financial objectives and executing on its strategic initiatives.

Overall, our success in this segment has been built on a vast network of global services that extend the life and improve the performance and quality of our customers’ critical components on demanding high-performance platforms. Backed by our global network of more than 70 facilities, we offer a bundling of highly technical services to both existing and new customers that includes shot peening, laser peening, coatings, and analytical testing services, a combination that is second to none across the numerous industries we serve.

Expansion Into Midstream and Upstream Oil and Gas

Over the past few years, we have experienced a mixed performance in our oil and gas end market. We continue to see strong global demand for our highly regarded MRO products and services. However, the ongoing weakness in our large, international projects business—which primarily includes products supporting down-stream refining operations such as coking and catalytic cracking—partially offsets this growth as these projects continue to move into the future.

To better position our overall technology offering in this key end market, we have recently transformed our oil and gas business through the acquisition of Cimarron Energy. Key to this transaction is the diversification that it provides to Curtiss‑Wright beyond a historic reliance on our core downstream refining capabilities. Cimarron expands our offering of products and services to encompass upstream and midstream oil and gas customers, most notably through energy production and processing equipment, as well as environmental solutions. Most significant to Curtiss‑Wright are the future opportunities that this business presents for expanding into the emerging, high-growth shale oil and gas markets, as well as for providing products focused on the environmental aspects of hydraulic fracturing or fracking.

Establishing an Industrial Cornerstone

Another key transformation taking place is the expansion of our offering in the industrial market beyond that of a purely component level supplier of sensors and controls products through the addition of new sensor and systems capabilities.

We historically have served the aerospace market, where Curtiss‑Wright has grown to become a leading provider of position sensors. Building on our existing solid base of sensor revenues, we have expanded our capabilities, product mix, and end market exposure through the addition of two new sensor companies—PG Drives and Williams Controls. PG Drives is a leader in highly engineered electronic controllers and drives for advanced electric- powered industrial and medical vehicles, providing expansion to the industrial sensors and controls market. Williams Controls develops advanced sensor and controls products for specialty vehicles, and also brings high-end systems capabilities to Curtiss‑Wright that serve as the cornerstone of our strategic initiative to become a systems level provider of electronics and controls across various markets.

Overall, combining these businesses with our existing capabilities will result in expanded sales coverage, exposure to new and growing markets, operational synergies as we integrate various facilities, and immediate access to high-growth emerging markets in both China and India.

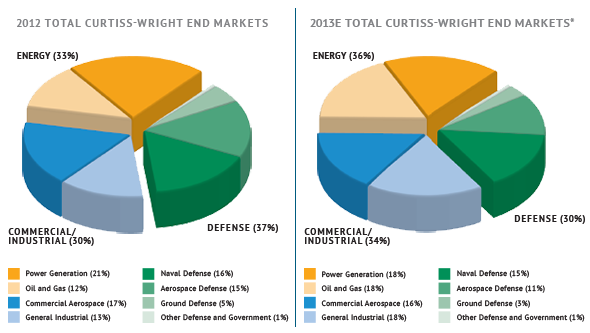

These are but a few of the many operational transformational actions that are reshaping our product portfolio. As a result of our recent acquisitions and the various transformations across our organization, we look ahead to 2013 with a steady balance of portfolio diversification that yields approximately one-third of our total revenues in each of defense, energy, and commercial/industrial markets, which more closely aligns our end market mix with our long-term strategic objectives.

Finance and IT Transformations

While we have worked through various operational transformations in 2012, we simultaneously have been working through transformations across our global finance and IT organizations. Throughout the past year, as part of Curtiss‑Wright’s continuous improvement and operational excellence strategy, our finance team has done a solid job advancing our cost reduction initiatives and increasing efficiency through ongoing process improvement. As a result, we have established various Curtiss‑Wright Centers of Excellence (COE), and a Shared Service Center, which together are expected to lead to significant savings of annual finance operating costs for years to come. Furthermore, we are taking the necessary steps towards achieving best-in-class finance benchmarks.

Going forward, we are developing standardized processes and procedures to more efficiently generate required data, and work more closely with the Shared Service Center and Centers of Excellence to automate reporting processes and other key activities. We believe these efforts will create a more centralized culture that unifies the global finance organization to better drive efficiency and leverage key resources. This, in turn, will allow operational financial management to focus their efforts on providing critical and strategic support to the business.

Likewise, our IT organization has been successfully working through a major transformation of its own: evolving into a single, global IT team that will help us effectively leverage all of our resources and assets to meet the dynamic needs of a global organization and support our plans for future growth. Similar to our finance team, our goal is to develop a best-in-class IT organization. The steps we have taken over the past two years—including the establishment of IT Shared Services and Enterprise Resource Planning Centers of Excellence—have put Curtiss‑Wright on track for success, with significant annual cost savings.

Advancing Our Leadership

A key transformation occurred in our senior leadership team as well in 2012, as I am proud to recognize the well-deserved promotion of David C. Adams to President and Chief Operating Officer of Curtiss‑Wright. I look forward to leveraging Dave’s strong combination of experience and leadership from managing both the Controls and Surface Technologies segments, as we continue to bolster the Company’s operational efficiency, expand our global footprint, and position Curtiss‑Wright for the future.

Finally, I would like to thank the continued dedication and hard work of our approximately 9,300 employees and welcome those who joined us via acquisition throughout 2012. Your ongoing drive and commitment will ensure our continued success.

As we look to the future, I remain optimistic that Curtiss‑Wright will continue on a path of solid organic growth supplemented by strategic acquisitions, as well as improved profitability and operational efficiency, supporting long-term shareholder value.

Martin R. Benante

Chairman and Chief Executive Officer