Dear Shareholders:

Martin R. Benante

Chairman and Chief Executive Officer

The year 2009 marks a milestone in the history of our company. The formation of Curtiss-Wright 80 years ago united the visionary corporations created by the "Fathers of American Aviation" — Glenn Curtiss and the Wright brothers. Innovation and discipline drove our founders' success, and they were able to achieve what few people had even envisioned.

The drive for technological innovation and superior performance still fuels Curtiss-Wright today. The Wright brothers' critical wing designs and Curtiss' engine advances are echoed today in stealth weapon bay door systems on fighter jets, command and control of next-generation unmanned aircraft and ground vehicles, generators and pumps that power nuclear submarines and aircraft carriers, and fully automated technology advances that keep people out of harm's way in vital power generation, refining and industrial operations around the world.

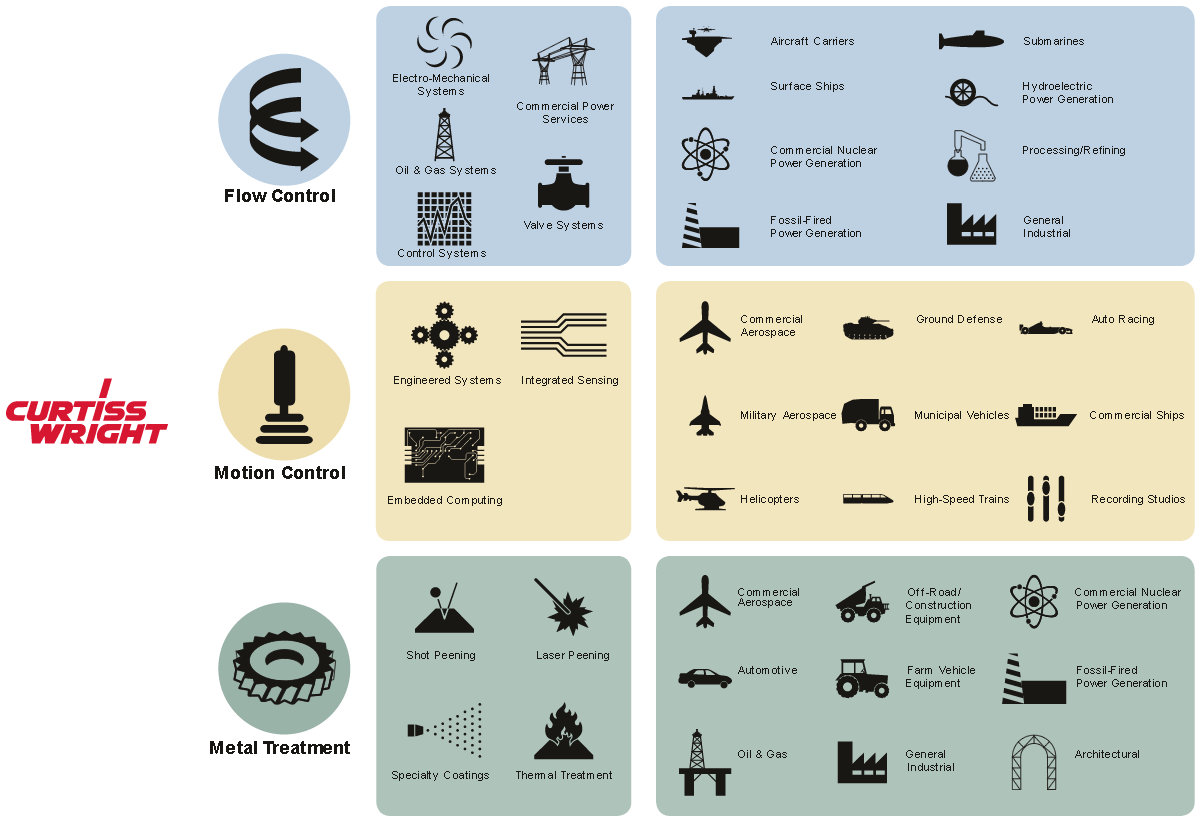

I have often cited the importance of our diversified business model to our long-term success. That diversification, combined with our focus on innovation and high-performance engineering, adds stability to our results and supports growth through varying economic conditions. This was again true in 2009.

2009 Performance

Without a doubt, 2009 was a year full of challenges that the global economy has not experienced in decades. The ripple effect of the financial market meltdown, volatile energy prices and a dramatic downward correction in the housing market manifested early in 2009 with a 6.4% decline in gross domestic product and concluded the year with double-digit unemployment. While many reactions centered on cost cutting, cash conservation and otherwise battening down the hatches, our strong backlog and portfolio diversification enabled us to successfully weather the downturn while maintaining our focus on long-term growth. As the economic recovery gains footing in 2010, our portfolio of highly engineered products is well positioned to benefit from increasing demand, and our strong capitalization will enable us to actively pursue our strategic growth plan.

In 2009, net sales of $1.8 billion represented a decline of 1% from the prior year. This is not to say we did not endure difficulty. Certainly, sagging demand for energy, transportation and industrial goods led to significant contractions in our commercial markets. While hardships in the general economy provided significant headwinds, they were essentially offset by the buildup of our commercial nuclear business and the momentum of defense spending.

Our operating profitability was negatively impacted primarily by the sharp drop in commercial demand, resulting in an operating margin of 9.4% versus 10.7% in the prior year. While we focus on lean efficiency improvements in good times and bad, in 2009 we accelerated business consolidation and restructuring activities across our operations. Lowering costs to respond to reduced market demand is, frankly, an unrewarding task, but we implemented our plans swiftly, and the result is a leaner, more efficient operation that will ultimately benefit from our cohesive strategy. Some of the benefits from these actions came in fiscal 2009, but we expect further leverage from these improvements for our businesses going forward.

On the bottom line, our net earnings of $95 million, or $2.08 per fully diluted share, reflect a less than satisfying 13% decline from the prior year, but still an impressive achievement in light of the challenges endured. Furthermore, our significant free cash flow of $121 million provides considerable liquidity for strategic growth as our markets rebound. Curtiss-Wright skillfully navigated the downward trends in 2009 because of the expertise, flexibility and relentless dedication of our employees.

View our Business Diagram

View our Business Diagram