Investment Stewardship

Leadership messages

A message from our Chief Executive Officer

As we embarked on preparing this report, we considered the need to expand its scope. We are mindful of our responsibility not only for managing risks that fall under the umbrella of ESG but also for managing the many other risks inherent in our stewardship of the business. We decided to reimagine this publication as a report of Investment Stewardship. There are numerous definitions of investment stewardship in the market today, few of which fit our role as a passive investor with limited ability to influence the decisions of Operators. We define investment stewardship as the responsible allocation, management and oversight of our capital to create value for our stakeholders.

In this report, we have chosen to integrate more of the risks we face as stewards of our business. In addition to ESG risks, we regularly evaluate risks associated with broad market factors such as changing commodity prices and interest rates, the availability of competing sources of capital for mining projects, the availability of alternative investments to our stockholders such as alternative investments, technical risks associated with the development and operation of our portfolio of investments, geopolitical events, cybersecurity and regulatory changes in the jurisdictions where we maintain our stream and royalty interests.

Our ability to properly manage these risks is reflected in the ultimate assessment of our business: the valuation premium investors are willing to pay for Royal Gold shares.

We are aware of the heightened sensitivity to the term “ESG” in markets and political discourse, particularly in the United States. Nevertheless, the risks covered by the acronym ESG remain deeply embedded in the way we do business and an inability to address them would diminish our valuation. We have not moved away from these core factors, nor from using the term “ESG” where appropriate. Instead, we will address ESG risks in a broader discussion aimed at assisting our stakeholders’ understanding of risks facing our business.

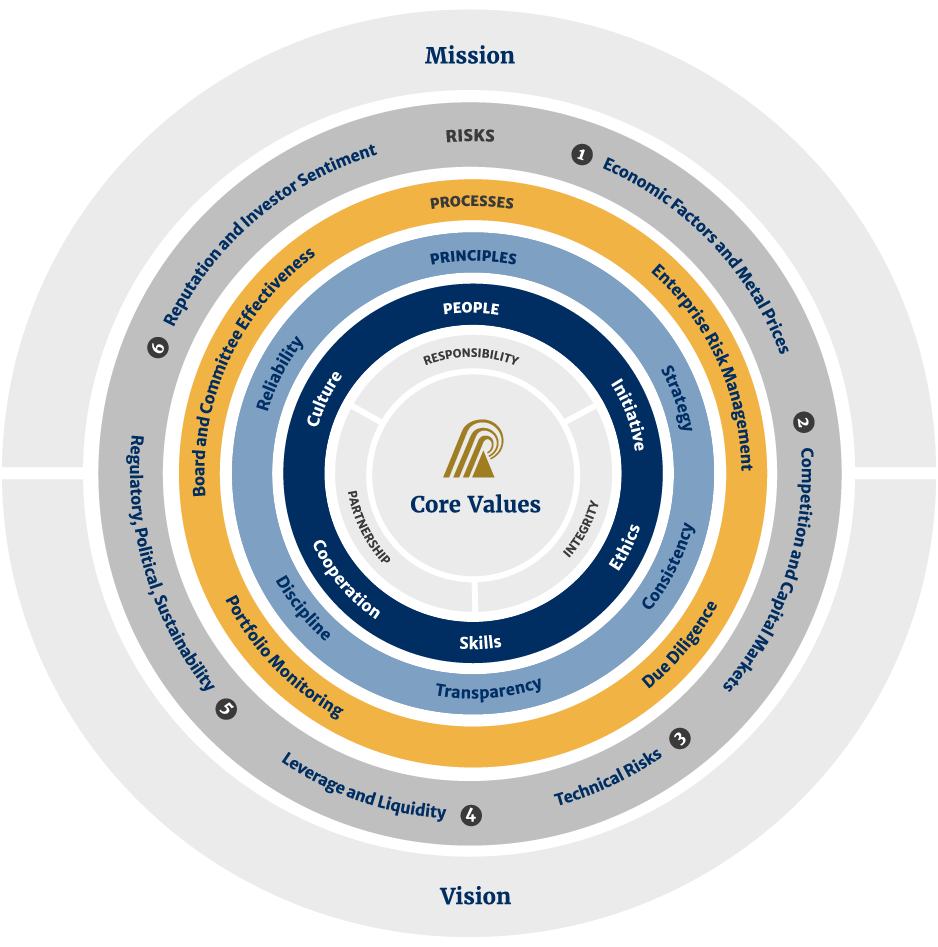

Similarly, our Vision, Mission and Core Values, first outlined in our 2021 ESG Report, remain unchanged, and this report will give you a sense for how we have applied those to our People, our Principles and our Processes as discussed on page 20. Our experienced team is committed to conducting our business in a professional, honest and transparent manner. Our Board has the requisite diversity of skills to support us in the management of our business.

In this report, we have grouped our corporate risks into six categories: 1) Economic Factors and Metal Prices, 2) Competition and Capital markets, 3) Technical Risks, 4) Leverage and Liquidity, 5) Regulatory, Political and Sustainability, 6) Reputation and Investor Sentiment, which collectively outline our approach to Investment Stewardship. We also summarize key events and important milestones from 2023. Interspersed in these discussions are the same rigorous descriptions of those key factors in the areas of the environment, human capital and corporate governance.

During the reimagination of this report, we also decided to publish a separate Climate Report, which we believe provides our investors and stakeholders with more comprehensive information relating to our climate change risks and opportunities.

Sincerely,

William H. Heissenbuttel

President and Chief Executive Officer

In conversation: A roundtable discussion with members of our Board

Royal Gold Board of Directors, Bill Hayes, Sybil Veenman and Jamie Sokalsky reflect on topics from investment stewardship to climate, underscoring risk management as a long-standing and fundamental aspect of operating the business in a responsible and sustainable manner.

Q: Royal Gold made a purposeful shift from ESG to Investment Stewardship with this report. Why is this an important distinction?

Sybil Veenman: Personally, I’ve found the term ESG to be overly broad, covering a vast array of topics from climate and water use to human capital and cybersecurity. These and other topics that fall under the ESG label have always been considerations for managing our business for strong, sustainable returns in a responsible manner. The recent shift to investment stewardship resonates with our business model as we are primarily passive investors with indirect influence. Investment stewardship, as a term, reflects a more comprehensive view of our investment decision-making, considering not just environmental and social aspects but also market dynamics and geopolitical events. It’s simply a more accurate description of what we do, offering a better starting point for educating stakeholders about our business model and the challenges we face.

Bill Hayes: Regardless of the shift in terminology, we haven’t changed the way we do business. We will continue to disclose our risks, report the way we manage them and share that story, whether it is through policies, statements or in a consolidated report like this one. We have a strong history of telling our stories – positive and negative – and that differentiates us.

Q: Have you seen any significant changes in the issues that are being brought forward in this reporting year when compared to prior reports?

Sybil Veenman: This report is a continuation of robust ESG disclosures we have made in the past while integrating our new investment stewardship themes. One important change we made this year to our Board activities is increasing the time of our Compensation, Nominating and Governance (CNG) Committee meetings, which has given us more time to discuss and evaluate topics related to sustainability. Climate continues to be an important topic of our discussions. Our own climate impacts – that is, our direct corporate-related impacts – are relatively easy to explain and understand, but our role as an investor and lack of influence for the climate impacts of the assets we are invested in is more complicated.

Jamie Sokalsky: Climate is an example of a challenge for us as we try to deepen our disclosures because we do not control the actions of our Operators. Externally, we see increasing pressure from regulators and investors on climate matters, and as a result, we are having ongoing discussions about how we manage and report our attributable emissions. The publication of our first climate report this year is a step in the right direction for more in-depth climate reporting.

Q: As the world changes across many dimensions, so do the risks to our business. How does Royal Gold evolve its approach to investing and meeting shareholder expectations for managing these risks?

Bill Hayes: We have integrated new tools to help us better assess risks associated with water stress and we are taking a closer look at biodiversity risks to new and existing portfolio interests. I believe these measures will enhance our already robust due diligence and operational oversight systems. Our management team continuously looks for new and integrative ways to address operational risks while balancing stakeholder expectations.

Jamie Sokalsky: Our team has in-depth experience overseeing varying levels of risk in many different jurisdictions. When comparing today versus a decade ago, we are reviewing much more closely, and trying to anticipate, regulatory change and stakeholder requirements with respect to climate, water stress, etc. Many of our Operators have successfully navigated or continue to navigate increasing political uncertainty while adapting to regulatory change and managing stakeholder concerns.

Bill Hayes: Many investors expect the highest possible returns; however, we need to maintain balance in our portfolio and really, what we are seeking here as a company, and as a Board, is balance. We are running a business with shareholders waiting for dividends and stakeholders waiting for projects that aim to contribute positively to local economies. I am confident we are well positioned to maintain our focus through our stewardship of a diverse investment portfolio and a balanced approach to sustainability.

Q: How do you decide which Operator communities to support?

Bill Hayes: We are actively and creatively looking to support our Operators, the local communities where we have offices and the mining industry at large, and we seek projects where we can contribute and make a meaningful difference. One approach we’ve taken with respect to our Operators is a contribution based on gold equivalent ounces produced. We are proud to see our contributions go toward the development of a functioning medical clinic in Botswana where there wasn’t one last year. We strive to make contributions that are good for the community and our Operators.

2023 highlights

1 In this report, we segment scope 3 corporate emissions into those arising from our corporate activities (which we refer to as our scope 3 corporate emissions) and those of our portfolio Operators (which we refer to as our scope 3 investment emissions). We have done this because, as a passive investor, we do not have direct influence or control over the Operator’s emissions but do manage and assert more control over our own direct footprint. Our scope 3 corporate emissions are largely those associated with business travel and employee commuting.

Principles of Investment Stewardship

Royal Gold is committed to conducting business with discipline, consistency, strategy, transparency and reliability, integrating these values into every aspect of our operations, as reflected in our Mission, Vision and Core Values. Our conduct and efforts continue to contribute to a sustainable and responsible business approach while guiding the way forward on People, Principles and Processes.

Governance

Our ability to identify and manage risks, including ESG risks, in our corporate operations and portfolio interests is fundamental to our long-term success. With a history of dedicated focus on rigorous oversight from our Board and its committees, coupled with the effective execution of strategies by our people, we are well positioned to not only navigate challenges but also to advance our business. This long-standing commitment to strong governance is an integral component in our approach to sustainable and responsible investment stewardship.

Hope Project is dedicated to mitigating vulnerability among children and young adults in the Nova Xavantina region by offering a nurturing and positive environment enriched with sociocultural, educational, recreational and vocational activities. This initiative seeks to lower school dropout rates and foster improved living conditions and financial autonomy for those at risk. We greatly appreciate Royal Gold’s financial support in these efforts.”

Feature stories

Mining community contribution highlights

Royal Gold’s mining community contributions focus on supporting programs in the communities where we hold stream or royalty interests that promote sustainable development on a global scale.

Improving educational outcomes, Tristar Gold

Royal Gold contributed funds in 2023 to help Tristar Gold (“Tristar”) facilitate the reconstruction of the João Paulo II Elementary School in the Community of Vila Esperança IV, which is the closest village to the Company’s Castelo de Sonhos project in Para State, Brazil.

Expanding young minds and improving classroom attendance, Ero Copper Corp.

Royal Gold has committed to contributing $5 per ounce of gold delivered under its stream agreement with Ero Copper (“Ero”). These funds are to assist Ero in fulfilling its ESG commitments within the area of influence of the Xavantina mine in Brazil.

Improving quality of education through school strengthening, Newmont Corporation

In 2023, Royal Gold provided $150,000 in funding towards two projects near the Peñasquito mine in Zacatecas, Mexico: Proeducación IAP – Excellence in Schools Initiative and University of Zacatecas Foundation.

Local office community contribution highlights

Our internal Donations Committee administers our annual charitable giving and selects donation recipients in our local office communities, which include Denver, Lucerne, Toronto and Vancouver.

Spitex, Lucerne, Switzerland

Spitex is a non-profit organization whose primary mission is to provide on-site healthcare for those residents of Lucerne who need outpatient care but are otherwise capable of remaining in their preferred home surroundings. Services provided include palliative and cancer care, psychological assistance, and physical and household services for the physically impaired. Royal Gold has supported Spitex since 2020, providing a total of $438,000, which has helped support two areas important to the organization.

Project C.U.R.E., Colorado, U.S

Royal Gold has played a supportive role over the years by providing financial support to Project C.U.R.E. for the distribution of medical supplies and the purchase of box trucks and a forklift. In 2023, Royal Gold made a $75,000 donation to Project C.U.R.E. to support the humanitarian relief efforts related to the earthquakes in Turkey and Syria in early 2023. Since 2020, Royal Gold has donated a total of $638,315 to Project C.U.R.E.

Food Bank Contributions

Royal Gold has supported the Food Bank of the Rockies (Colorado, U.S.), the Greater Vancouver Food Bank (Vancouver, Canada) and the Daily Bread Food Bank (Toronto, Canada) since 2020, with a combined total contribution of over $575,000.

Royal Gold endeavors to support programs that aim to achieve impactful, measurable and sustainable outcomes that align with one or more of the Sustainable Development Goals (SDGs).